All Categories

Featured

Table of Contents

Juvenile insurance policy provides a minimum of defense and can provide coverage, which may not be readily available at a later date. Quantities supplied under such protection are generally restricted based upon the age of the youngster. The current limitations for minors under the age of 14.5 would be the greater of $50,000 or 50% of the quantity of life insurance coverage effective upon the life of the candidate.

Juvenile insurance policy might be offered with a payor advantage biker, which attends to forgoing future premiums on the kid's policy in case of the fatality of the person who pays the premium. Senior life insurance policy, in some cases referred to as graded death advantage plans, supplies eligible older applicants with marginal entire life protection without a medical examination.

The optimum concern quantity of insurance coverage is $25,000. These plans are usually much more costly than a totally underwritten policy if the individual qualifies as a basic risk.

Our term life options consist of 10, 15, 20, 25, 30, 35, and 40-year policies. The most popular kind is level term, indicating your settlement (premium) and payment (survivor benefit) stays level, or the exact same, up until completion of the term period. This is the most straightforward of life insurance policy alternatives and requires really little upkeep for policy owners.

What does a basic Guaranteed Level Term Life Insurance plan include?

As an example, you might provide 50% to your spouse and divided the remainder among your grown-up children, a parent, a good friend, or perhaps a charity. * In some circumstances the fatality advantage might not be tax-free, find out when life insurance policy is taxed

1Term life insurance policy supplies temporary protection for an essential period of time and is generally less costly than long-term life insurance. 2Term conversion standards and constraints, such as timing, may use; as an example, there may be a ten-year conversion privilege for some items and a five-year conversion benefit for others.

3Rider Insured's Paid-Up Insurance coverage Acquisition Option in New York City. 4Not available in every state. There is an expense to exercise this biker. Products and riders are available in accepted jurisdictions and names and attributes may differ. 5Dividends are not ensured. Not all taking part policy proprietors are qualified for dividends. For choose cyclists, the condition relates to the guaranteed.

How do I apply for Level Premium Term Life Insurance?

We might be compensated if you click this advertisement. Advertisement Level term life insurance policy is a policy that provides the very same death benefit at any type of point in the term. Whether you die on the exact same day you secure a plan or the last, your beneficiaries will certainly get the very same payment.

Policies can likewise last up until specified ages, which in most cases are 65. Past this surface-level info, having a better understanding of what these strategies involve will help guarantee you buy a policy that satisfies your needs.

Be conscious that the term you select will certainly influence the costs you spend for the plan. A 10-year degree term life insurance policy policy will certainly cost much less than a 30-year policy because there's much less opportunity of an occurrence while the strategy is energetic. Reduced risk for the insurance company corresponds to decrease premiums for the insurance policy holder.

How do I choose the right Level Premium Term Life Insurance?

Your household's age must likewise influence your policy term choice. If you have young kids, a longer term makes sense because it shields them for a longer time. If your children are near the adult years and will be monetarily independent in the near future, a shorter term could be a better fit for you than an extensive one.

When comparing entire life insurance vs. term life insurance policy, it's worth noting that the last commonly costs much less than the former. The outcome is more insurance coverage with lower premiums, offering the best of both worlds if you require a significant quantity of insurance coverage yet can not manage a more pricey policy.

Level Term Life Insurance Policy Options

A degree death advantage for a term plan normally pays out as a swelling sum. When that happens, your heirs will certainly receive the entire amount in a solitary payment, and that amount is not thought about income by the IRS. Consequently, those life insurance profits aren't taxable. Some degree term life insurance firms allow fixed-period settlements.

Passion payments received from life insurance coverage policies are considered earnings and are subject to taxation. When your level term life plan expires, a couple of different points can occur.

The drawback is that your renewable degree term life insurance policy will come with greater costs after its initial expiration. Advertisements by Money. We may be made up if you click this advertisement. Advertisement For beginners, life insurance policy can be made complex and you'll have inquiries you want responded to prior to committing to any type of plan.

What is included in Level Term Life Insurance Benefits coverage?

Life insurance policy business have a formula for computing threat utilizing death and interest. Insurers have countless clients getting term life plans at once and use the costs from its energetic plans to pay surviving beneficiaries of various other policies. These business utilize mortality to approximate the number of people within a specific team will file death insurance claims annually, and that information is utilized to figure out ordinary life expectancies for possible policyholders.

Furthermore, insurance policy companies can invest the money they get from costs and raise their income. The insurance company can spend the money and earn returns - No medical exam level term life insurance.

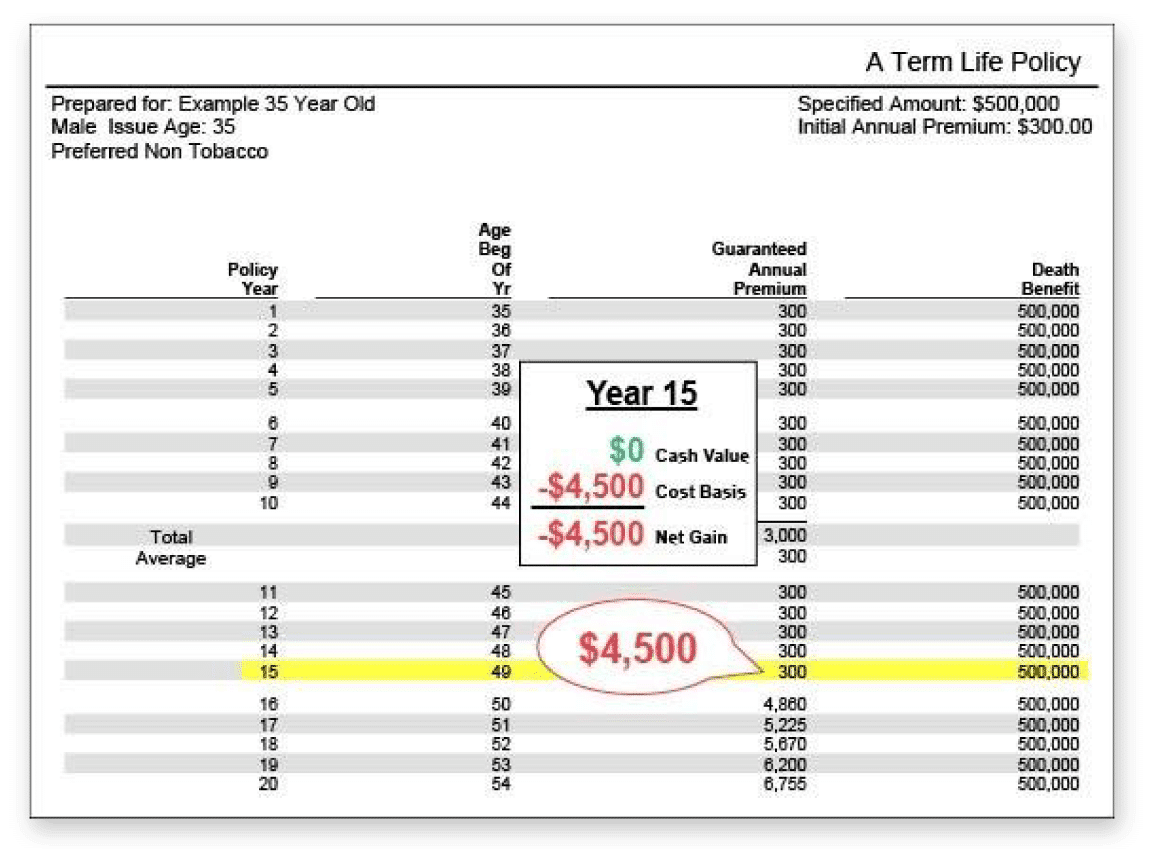

The complying with area details the pros and disadvantages of degree term life insurance coverage. Foreseeable costs and life insurance policy coverage Simplified plan framework Prospective for conversion to long-term life insurance Limited protection period No cash money worth accumulation Life insurance policy costs can enhance after the term You'll locate clear advantages when comparing degree term life insurance to various other insurance kinds.

What should I know before getting Tax Benefits Of Level Term Life Insurance?

You constantly understand what to anticipate with low-priced degree term life insurance policy protection. From the moment you obtain a plan, your costs will never transform, assisting you prepare monetarily. Your protection will not differ either, making these policies reliable for estate preparation. If you value predictability of your repayments and the payouts your beneficiaries will receive, this kind of insurance can be an excellent fit for you.

If you go this route, your premiums will increase however it's always good to have some adaptability if you desire to maintain an energetic life insurance policy plan. Renewable level term life insurance policy is an additional option worth taking into consideration. These plans enable you to keep your existing plan after expiry, giving versatility in the future.

Latest Posts

Homestead Funeral Insurance

Compare Funeral Covers

How To Sell Final Expense Insurance Online