All Categories

Featured

Table of Contents

Many whole, universal and variable life insurance policy policies have a money worth part. With one of those policies, the insurance firm transfers a part of your regular monthly premium settlements into a cash money value account. This account makes rate of interest or is spent, helping it expand and provide a more considerable payment for your recipients.

With a level term life insurance policy policy, this is not the instance as there is no cash money value element. Because of this, your policy will not grow, and your survivor benefit will certainly never ever enhance, thus limiting the payment your recipients will certainly receive. If you desire a plan that gives a survivor benefit and develops cash money worth, explore whole, global or variable strategies.

The second your policy expires, you'll no longer have life insurance protection. Level term and lowering life insurance offer similar plans, with the main distinction being the fatality benefit.

(EST).2. Online applications for the are offered on the on the AMBA web site; click on the "Apply Now" blue box on the right hand side of the web page. NYSUT members can additionally print out an application if they would certainly like by clicking on the on the AMBA website; you will then require to click on "Application Type" under "Kinds" on the appropriate hand side of the web page.

What does Low Cost Level Term Life Insurance cover?

NYSUT participants enrolled in our Degree Term Life Insurance Plan have actually accessibility to provided at no additional expense. The NYSUT Participant Conveniences Trust-endorsed Level Term Life Insurance Policy Plan is financed by Metropolitan Life Insurance coverage Business and provided by Organization Member Perks Advisors. NYSUT Trainee Members are not eligible to take part in this program.

Term life insurance policy is a budget friendly and simple choice for lots of people. You pay premiums each month and the coverage lasts for the term length, which can be 10, 15, 20, 25 or three decades. What happens to your premium as you age depends on the type of term life insurance policy coverage you get.

As long as you remain to pay your insurance policy costs monthly, you'll pay the same price during the entire term length which, for numerous term policies, is generally 10, 15, 20, 25 or thirty years (Level premium term life insurance). When the term ends, you can either choose to finish your life insurance protection or renew your life insurance policy plan, normally at a higher price

Who provides the best Level Term Life Insurance Policy?

A 35-year-old female in superb wellness can buy a 30-year, $500,000 Haven Term plan, released by MassMutual starting at $29.15 per month. Over the following three decades, while the policy remains in place, the expense of the insurance coverage will certainly not transform over the term duration. Allow's encounter it, the majority of us don't like for our expenses to grow in time.

Your level term price is established by a number of elements, the majority of which relate to your age and health. Other factors include your particular term plan, insurance policy carrier, benefit amount or payout. During the life insurance application process, you'll address questions about your wellness history, consisting of any type of pre-existing conditions like an essential disease.

It's always very vital to be sincere in the application process. Issuing the policy and paying its advantages depends on the applicant's proof of insurability which is established by your response to the health and wellness inquiries in the application. A medically underwritten term policy can secure an economical rate for your protection period, whether that be 10, 15, 20, 25 or thirty years, no matter just how your health and wellness might transform during that time.

With this kind of level term insurance coverage, you pay the exact same month-to-month costs, and your recipient or recipients would get the very same benefit in case of your fatality, for the entire protection duration of the policy. Just how does life insurance job in terms of expense? The cost of level term life insurance will certainly rely on your age and health as well as the term length and protection quantity you choose.

Can I get Level Term Life Insurance For Seniors online?

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Female$1,000,00030$43.3135 Male$500,00020$20.7235 Female$750,00020$23.1340 Male$600,00015$22.8440 Women$800,00015$27.72 Price quote based upon pricing for qualified Place Simple applicants in exceptional health. Pricing distinctions will certainly differ based on ages, health and wellness condition, protection quantity and term size. Sanctuary Simple is presently not offered in DE, ND, NY, and SD.Regardless of what protection you select, what the plan's cash worth is, or what the lump sum of the death advantage becomes, assurance is amongst the most useful benefits related to acquiring a life insurance policy policy.

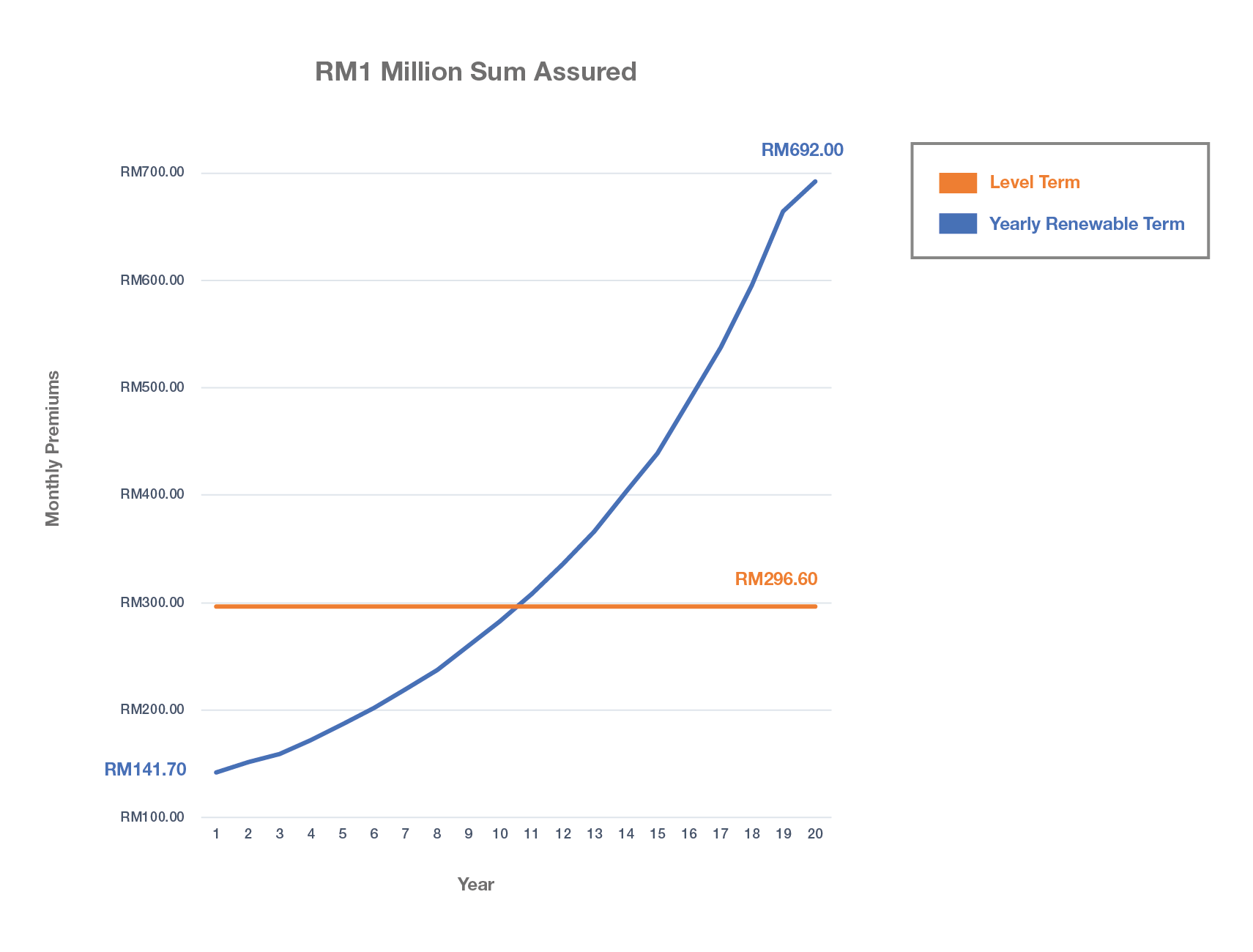

Why would someone pick a plan with an each year sustainable premium? It might be an option to consider for someone that requires insurance coverage just momentarily.

You can generally restore the plan each year which offers you time to consider your options if you want insurance coverage for longer. That's why it's useful to purchase the ideal amount and size of protection when you initially obtain life insurance policy, so you can have a low rate while you're young and healthy and balanced.

If you add crucial overdue labor to the home, such as childcare, ask on your own what it could cost to cover that caretaking job if you were no more there. Then, see to it you have that protection in location to make sure that your household gets the life insurance policy benefit that they require.

Why do I need Best Level Term Life Insurance?

For that set amount of time, as long as you pay your costs, your rate is steady and your beneficiaries are safeguarded. Does that mean you should always select a 30-year term length? Not always. In general, a shorter term policy has a reduced premium rate than a much longer policy, so it's clever to choose a term based on the forecasted length of your economic duties.

These are very important variables to maintain in mind if you were thinking of choosing a permanent life insurance coverage such as an entire life insurance coverage plan. Many life insurance policy policies offer you the alternative to include life insurance policy cyclists, assume additional advantages, to your plan. Some life insurance policy policies include bikers integrated to the cost of costs, or riders may be readily available at an expense, or have actually fees when exercised.

With term life insurance coverage, the interaction that the majority of individuals have with their life insurance policy business is a monthly expense for 10 to 30 years. You pay your monthly costs and hope your family will never need to utilize it. For the team at Haven Life, that appeared like a missed chance.

Latest Posts

Homestead Funeral Insurance

Compare Funeral Covers

How To Sell Final Expense Insurance Online